A Business Improvement District (BID) is a formally recognized non-profit organization dedicated to improving the quality of life in a defined region. BIDs vary in the supplemental services they provide, such as public safety, maintenance, marketing, and capital improvements. The efforts are funded by a special assessment paid by the property owners in the district. A BID is a public/private partnership, which allows governing bodies and property/business owners to unite in a collective effort for the maintenance, development, and promotion of their commercial district. They can help to manage vagrants and homeless encampments and all the filth and trash that they produce on city streets and sidewalks.

BIDs in Central Los Angeles

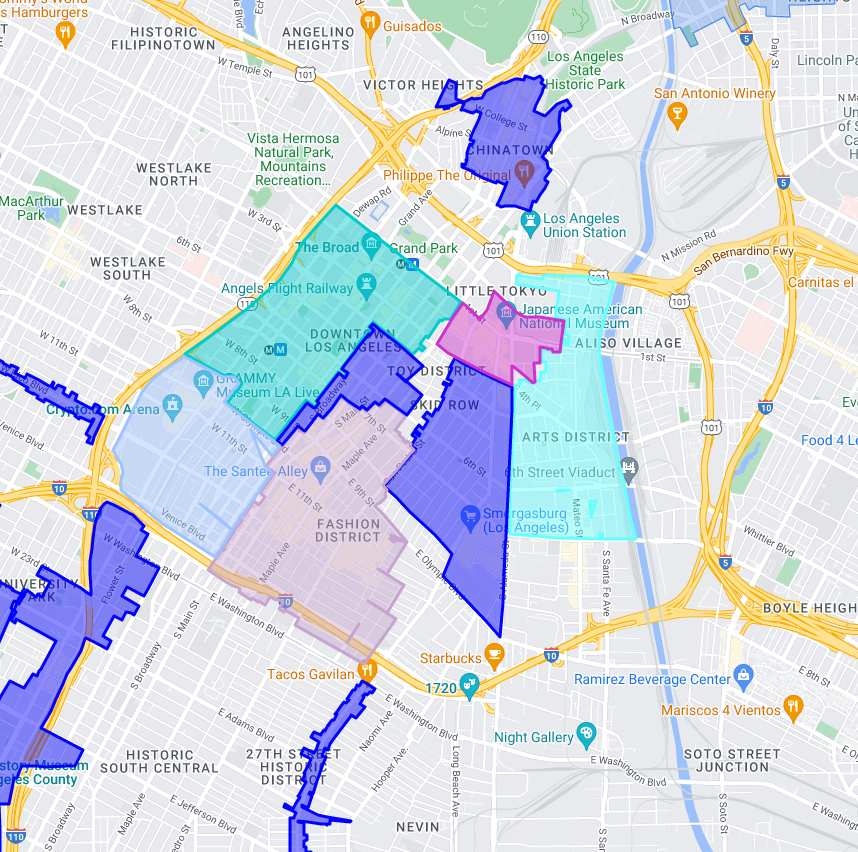

The Downtown LA Industrial District BID extends from San Pedro to Alameda Streets and from 3rd Street to Olympic Boulevard— a nearly 50-block area in the heart of Downtown Los Angeles. This area is the historic home of seafood, produce, flowers and a variety of products shipped in and out of Los Angeles by air, rail and sea. It’s also home to wholesalers, restaurants, cafes, and in more recent years startups and mixed-use retail/office centers.

The South Los Angeles Industrial Tract Business Improvement District was established in 2007 and has had a tremendous impact in improving the area. SLAIT, aka the Goodyear Tract, has a long history as a vibrant industrial district and looks forward to a promising future. It is one of the more active business districts in the City, with approximately $1.4 billion in sales, over 200 companies, and approximately 4,000 employees. The South LA Industrial Tract BID is a self-imposed, annually assessed, Business Improvement District (BID) comprised of 152 commercial property owners representing over 400 parcels. The BID was formed with the sole purpose of enhancing the industrial area primarily through safety and maintenance programs and is approximately 22 blocks; an area bounded roughly by Slauson Avenue on the North, Florence on the South, Central Avenue on the East and Avalon Avenue on the West.

The Arts District is a fiercely original, urban neighborhood, situated on the eastside of Downtown, boarded by the Los Angeles River and walking distance to Union Station and City Hall. The district is home to galleries, restaurants, creative office space, live/work lofts and upscale condos with a hip urban vibe. The streets are rich in character as local street artists have turned building walls into canvases showcasing their artwork. Many of the neighborhood’s business establishments are tucked into early 20th century warehouses and former factories. Institutions like the Hauser and Wirth Gallery, the Southern California Institute of Architecture and the Los Angeles Clean Technology Incubator help give the Arts District its distinct character.

The LA Fashion District Business Improvement District (BID) serves a 107-block area generally between 7th Street to the north and the Santa Monica 10 Freeway to the south, and from Broadway to the west and Paloma Street to the east.