A San Francisco developer has filed plans to build a 261,000-square-foot data center in the Los Angeles County industrial hub – the City of Vernon.

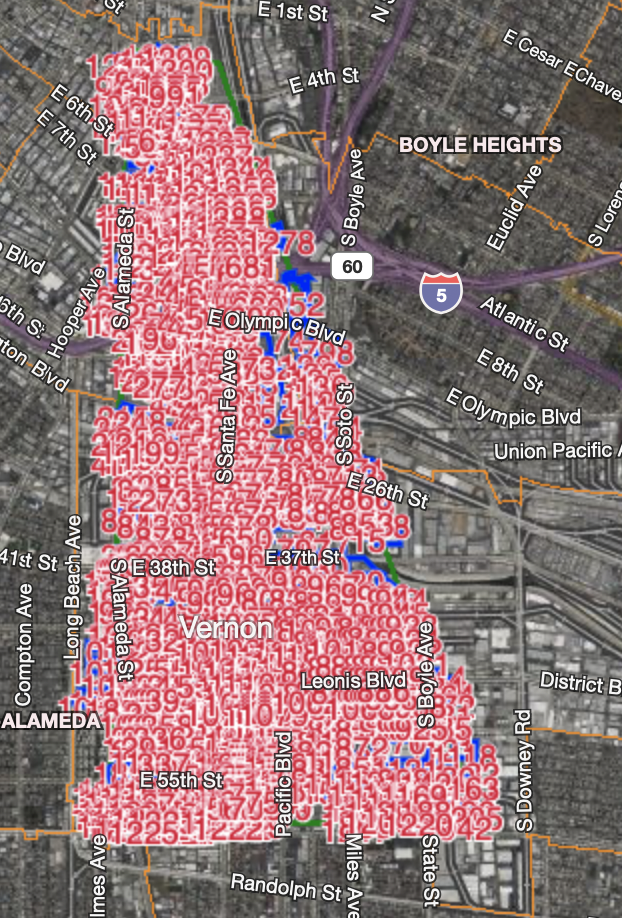

Prime Data Centers, a wholesale data center developer and operator, has proposed a three-story building on 4.5 acres at 4701 S. Santa Fe Ave., five miles south of Downtown Los Angeles, the Los Angeles Business Journal reported.

The first known data center in the industrial city will replace a 224,600-square-foot garment manufacturing facility built in 1946 and last renovated in 2001, according to Dgtl Infra Real Estate. The property was most recently listed for $30 million.

The new data center is expected to deliver up to 33 megawatts of power to its tenants. The company is also creating a 49.5 megavolt amp substation that will service the new site. Completion is expected in the fourth quarter of next year.

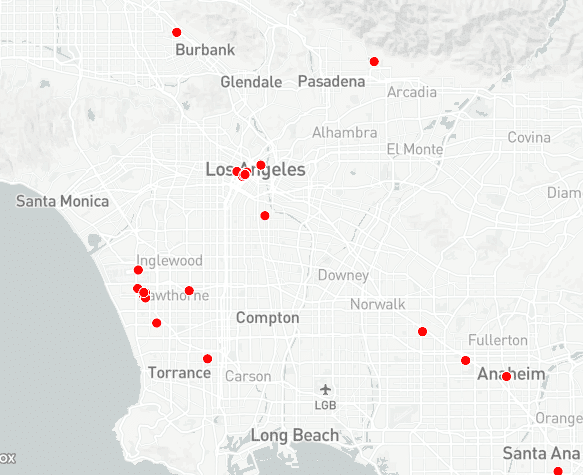

One of Los Angeles’ key strengths is its diverse long-haul fiber and subsea cable connectivity, according to Dgtl Infra. L.A. gives long-haul fiber routes linking Phoenix and Las Vegas access to the West Coast, while serving as a key access point for long-haul fiber routes between Mexico and Canada.

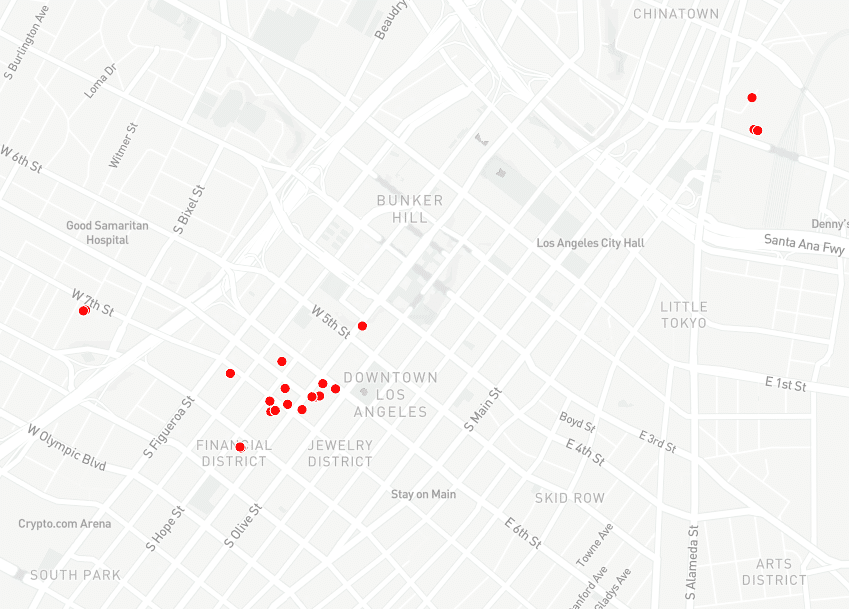

To this end, Prime Data Centers’ Vernon facility will be carrier-neutral and up to five miles away from major interconnection hubs at One Wilshire, 600 W. Seventh St., 530 W. Sixth St., 900 N. Alameda and 818 W. Seventh St. in Downtown Los Angeles, DTLA.

“Los Angeles is a thriving global connectivity market, and our new hyperscale Vernon data center will be right in the middle of it all,” Nicholas Laag, chief executive and founder of Prime Data Centers, said in a statement.

About Data Centers

The growing reliance on cloud computing and data storage has led to an increased demand for data centers. The two fastest growing segments of the data center space are hyperscalers and edge data centers. Hyperscalers are typically defined as business-critical facilities that are significantly larger than typical data centers and are designed to support robust and scalable applications. These assets are typically owned by companies such as Google, Amazon, Microsoft or Meta. A growth forecast from Data Bridge Market Research indicated that the hyperscale data center market will grow at a CAGR of roughly 29.32% between 2023 and 2035.

Edge data centers are located closer to the users and their devices that collect and transmit data, or wherever data is being generated. Generally, these centers work as the go-between between the cloud or centralized regional data centers and IoT (Internet of Things) devices and their associated cellular tower sites. There is an expectation for IoT devices to grow 16% in 2023 to have an estimated 16.7 billion active end points. This would show a CAGR of 26.1% between 2023 and 2030.

These data center facilities are the hub of the new economy and play a fundamental role in our society and digital economy. Their reliability and growth are critical for the continued development of our economy into Web 3.0.

The rapid growth of emerging technologies like Artificial Intelligence (AI) is fueling demand for data center capacity, already driven higher by the cascade of digital innovations over the past decade such as content streaming, cloud computing, machine learning (ML), Internet of Things (IoT), ecommerce and more. While other commercial real estate sectors are experiencing a decline in construction pipelines, data center development has reached an all-time high and will continue to grow to meet demand.

Contact us to locate potential sites for development.