There are two new listings of USDA industrial meat processing properties for sale in Southern California. Both are currently in operation.

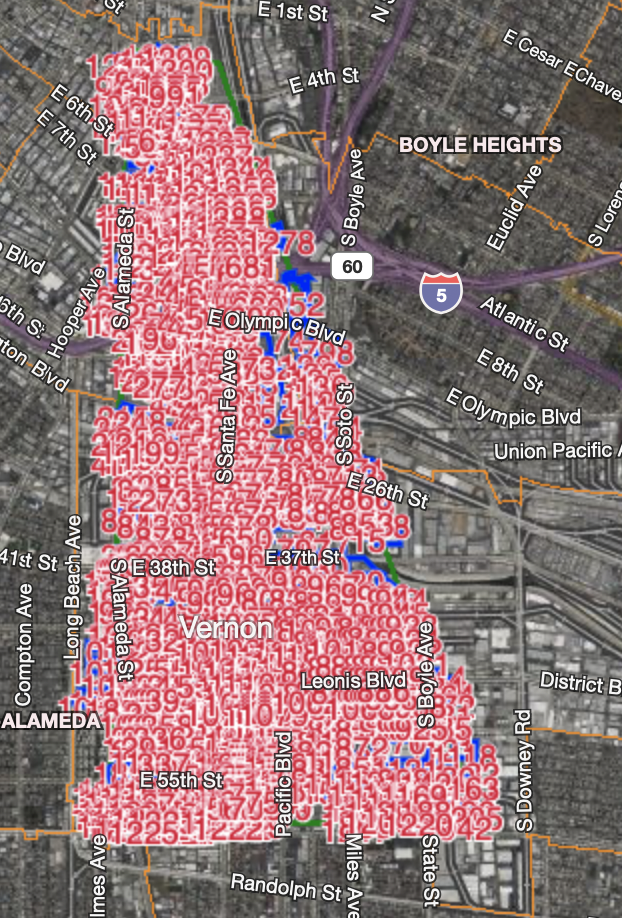

The first is located in the City of Vernon, Los Angeles County, and is 10,300 square feet in size with a fenced yard and dock high loading.

The second building is located in San Bernardino County and is 50,000 SF in size with fenced parking and dock high loading.

Both buildings have freezers, coolers, processing production rooms with floor drains and clarifiers for water treatment. This is a preliminary notice of these food facilities that may be available in the near future and might interest a buyer who deals in foods such as meats, poultry, beef, pet food, seafood, fish, Chinese or Latino foods, dairy, desserts, produce, fruits, vegetables, or meatless products for vegetarians or vegans.

Principals may contact me with any interest.